Table of Contents

- Executive Summary: Key Findings and Opportunities

- Market Landscape 2025: Size, Growth, and Leading Players

- Technology Deep Dive: Confluent Layer Fiberoptic Innovations

- Major Industry Drivers and Adoption Trends

- Competitive Analysis: Manufacturer Strategies and Partnerships

- Emerging Applications in Telecom, Data Centers, and Beyond

- Regulatory Standards and Industry Initiatives (e.g. ieee.org, tiaonline.org)

- Market Forecasts: Projections to 2030 and Scenario Analysis

- Challenges, Risks, and Barriers to Adoption

- Strategic Recommendations and Future Outlook

- Sources & References

Executive Summary: Key Findings and Opportunities

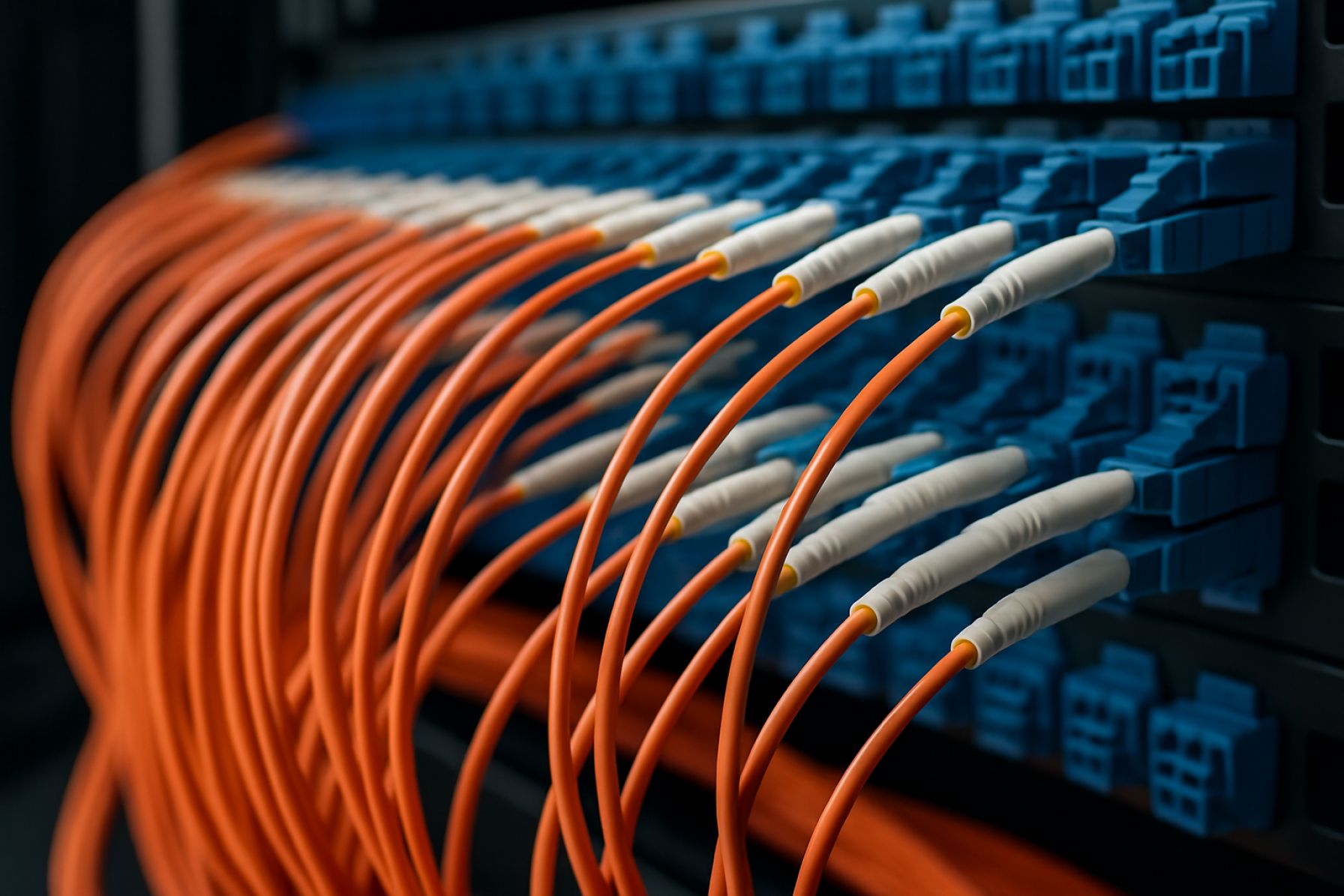

The fiber optic cabling industry is experiencing a paradigm shift in 2025, with confluent layer fiberoptic cabling systems emerging as a critical technology for next-generation data centers, enterprise networks, and communication infrastructure. These advanced cabling architectures, characterized by the seamless integration of multiple fiber layers within a single unified system, are driven by escalating demand for high-capacity, low-latency, and future-proof connectivity solutions. Major manufacturers and infrastructure providers are investing heavily in research and deployment, responding to surging bandwidth requirements from cloud computing, 5G, and AI-driven applications.

Key findings in 2025 highlight rapid adoption of high-density, modular confluent layer cabling in both greenfield and brownfield deployments. Companies such as CommScope and Corning Incorporated are rolling out innovative solutions featuring bend-insensitive fibers, micro-cabling designs, and pre-terminated modules that enable simplified installation, scalability, and reduced operational costs. Additionally, Panduit and Senko Advanced Components have introduced multi-fiber push-on (MPO) connector technologies optimized for confluent layer architectures, facilitating faster migration to 400G and 800G transmission rates.

Industry data from 2024–2025 indicates a notable increase in demand for confluent layer fiberoptic cabling systems in hyperscale data centers and metropolitan area networks (MANs). This is corroborated by deployment projects from Nexans, which has reported expanded contracts for next-generation cabling infrastructure supporting smart city and edge computing initiatives. Furthermore, the integration of software-defined networking (SDN) with fiber infrastructure is enabling real-time monitoring and automated management, as demonstrated by solutions from Belden Inc. and Legrand.

Looking ahead, the outlook for confluent layer fiberoptic cabling systems remains robust through 2027, buoyed by ongoing digital transformation, proliferation of IoT devices, and the global rollout of 5G/6G networks. Opportunities exist for further innovation in fiber densification, automated cable management, and environmentally sustainable materials. Collaboration between cabling manufacturers and network operators is expected to intensify, with joint ventures and standardization efforts likely to accelerate adoption and interoperability across industries.

In summary, confluent layer fiberoptic cabling systems represent a strategic opportunity for infrastructure modernization, offering unmatched scalability, reliability, and performance to meet the connectivity demands of the coming years.

Market Landscape 2025: Size, Growth, and Leading Players

The market landscape for Confluent Layer Fiberoptic Cabling Systems in 2025 is marked by robust growth, driven by surging demand for high-speed data transmission, cloud computing expansion, and the ongoing global rollout of 5G networks. Major telecommunications providers, data center operators, and enterprises are investing in next-generation cabling infrastructures to support increased bandwidth requirements, ultra-low latency, and network scalability.

Global demand for advanced fiberoptic cabling solutions is at an all-time high. In 2025, leading manufacturers such as Corning Incorporated, CommScope, and Panduit are reporting increased adoption of confluent layer designs—systems that optimize cable management and maximize fiber density without sacrificing accessibility or performance. These designs are especially prevalent in hyperscale data centers and urban core infrastructure, where space efficiency and rapid scalability are critical.

According to deployment data released in early 2025, Corning Incorporated highlighted a double-digit percentage increase in demand for their high-density cabling solutions, including Confluent Layer systems, particularly in North America and the Asia-Pacific region. Similarly, CommScope reported significant growth in orders for modular, pre-terminated fiber solutions as operators modernize their physical networks to support the exponential rise in connected devices and data-heavy applications such as AI and IoT.

Key market drivers include:

- 5G and future 6G deployments, requiring robust, scalable fiber backbones

- Edge computing expansion, demanding flexible, high-capacity cabling infrastructures

- Migration to 400G and 800G network architectures, necessitating higher fiber counts and minimized signal loss

Looking ahead to the next few years, the outlook remains positive. R&D investments by sector leaders like Panduit and Corning Incorporated are focused on further improving fiber density, modularity, and ease of installation. Standardization efforts by industry bodies, such as the Telecommunications Industry Association, are expected to accelerate market adoption by ensuring interoperability and best practices.

By 2027, confluent layer fiberoptic cabling systems are projected to be the preferred choice for new installations in core networks and data centers globally, as operators seek to future-proof their infrastructure against ongoing data growth and emerging digital applications.

Technology Deep Dive: Confluent Layer Fiberoptic Innovations

Confluent layer fiberoptic cabling systems represent a pivotal advancement in the physical infrastructure supporting high-bandwidth applications, data centers, and future-ready telecommunications networks. By integrating multiple optical fibers into unified, densely layered configurations, these systems deliver both increased capacity and operational flexibility, accommodating the explosive data growth anticipated through and beyond 2025.

Recent innovations have focused on the optimization of cable geometry and fiber density, with major manufacturers introducing next-generation micro-cabling and ribbonized fiber solutions. Companies such as Corning Incorporated have expanded their product lines with high-density, low-loss cabling specifically engineered for confluent layer deployments, enabling easier installation in constrained urban conduits and hyperscale environments. For instance, Corning’s latest ultra-compact cabling leverages advanced fiber coatings and flexible buffer materials to support hundreds of fibers in a single sheath, while maintaining bend insensitivity and signal integrity.

Similarly, CommScope has introduced innovative pre-terminated fiber solutions with modular, layered architectures, facilitating rapid deployment and scalability in new data center builds and network expansions. Their confluent layer systems employ precision-aligned connectors and robust protective jacketing, addressing both the need for high fiber counts and stringent reliability requirements in mission-critical settings.

In Europe and Asia, manufacturers like Prysmian Group and Furukawa Electric are also advancing confluent layer technologies, with a particular focus on sustainability and reduced installation footprint. Prysmian’s eco-friendly cable designs utilize recyclable materials and reduced-diameter structures, optimizing both resource use and network capacity for metropolitan and long-haul deployments.

Standardization efforts are underway, with industry groups such as the Telecommunications Industry Association (TIA) and International Telecommunication Union (ITU) developing guidelines for high-density optical cabling and performance benchmarks. These standards are expected to drive broader adoption of confluent layer systems from 2025 onwards, ensuring interoperability and future-proofing investments as global bandwidth demand surges.

Looking ahead, the outlook for confluent layer fiberoptic cabling is robust. Ongoing R&D focuses on further miniaturization, improved automation in installation, and integration with emerging technologies such as hollow-core fibers and photonic integrated circuits. As hyperscale data centers, 5G/6G backhaul, and edge computing continue to expand, confluent layer cabling will be central to enabling the next generation of high-speed, resilient, and scalable networks.

Major Industry Drivers and Adoption Trends

The adoption of confluent layer fiberoptic cabling systems is accelerating in 2025, driven by several converging industry trends and technological advancements. The demand for higher bandwidth, lower latency, and future-proof infrastructure in hyperscale data centers, 5G deployments, and enterprise campuses is prompting organizations to reevaluate traditional cabling architectures. Confluent layer designs, which emphasize high-density, modular, and scalable fiber management, are emerging as a preferred solution for these evolving requirements.

A key driver is the exponential growth in data traffic, fueled by cloud computing, AI workloads, and edge computing. According to Cisco Systems, Inc., global data center traffic is projected to continue rising sharply through 2025, necessitating fiber infrastructures that can support rapid, flexible reconfiguration and simplified management. Confluent layer systems offer enhanced optical performance and facilitate moves, adds, and changes with minimal disruption—a critical advantage as network topologies become more dynamic.

Another major factor is the ongoing global rollout of 5G networks and the associated densification of backhaul and fronthaul links. Providers such as Corning Incorporated and CommScope Holding Company, Inc. report heightened demand for pre-terminated, modular fiber solutions that can be rapidly deployed in urban and campus environments. Confluent layer cabling’s ability to integrate multiple fiber types and connection points within a unified management platform aligns well with these needs, reducing installation time and operational risk.

Sustainability and cost considerations are also shaping adoption. Organizations are increasingly looking for cabling systems that optimize space, reduce power consumption (by minimizing signal loss and the need for repeaters), and support longer product life cycles. Companies like Panduit Corp. and Belden Inc. are introducing solutions with compact footprints, enhanced accessibility, and robust documentation features to meet these requirements.

Looking ahead, the next few years are expected to see further standardization of confluent layer architectures as industry bodies such as the Telecommunications Industry Association (TIA) update guidelines to reflect evolving best practices. Adoption is likely to widen beyond hyperscale data centers to mid-sized enterprises and public sector networks, especially as digital transformation initiatives accelerate post-2025. The combination of operational efficiency, scalability, and readiness for emerging optical technologies positions confluent layer fiberoptic cabling systems as a foundational element of next-generation network infrastructure.

Competitive Analysis: Manufacturer Strategies and Partnerships

The competitive landscape for confluent layer fiberoptic cabling systems in 2025 is characterized by aggressive strategies from leading manufacturers, as well as a wave of collaborative partnerships aimed at addressing surging demand for high-capacity, low-latency network infrastructure. The ongoing global expansion of data centers, 5G rollouts, and the rapid adoption of AI-driven applications have compelled established players and emerging specialists to refine their approaches to product development, supply chain resilience, and customer engagement.

Major manufacturers like Corning Incorporated and CommScope have continued to invest heavily in R&D to improve the density and performance of their confluent layer cabling solutions. In 2024, Corning Incorporated announced enhancements to its EDGE™ and RocketRibbon® product lines, focusing on higher fiber counts and reduced installation time—critical for hyperscale data centers and metropolitan area networks. Similarly, CommScope introduced new modular platforms designed to support flexible, future-proof network architectures, catering to the growing need for scalable cabling in multi-tenant and distributed environments.

Strategic partnerships have become a hallmark of the sector. For instance, Panduit has expanded its collaboration with cloud service providers and large telecom operators to co-develop solutions optimized for AI workloads and edge computing. The company’s focus in 2025 includes integrating intelligent monitoring technologies into confluent fiber systems, enabling predictive maintenance and real-time network analytics. Meanwhile, Sumitomo Electric Industries, Ltd. has entered cooperative initiatives with regional ISPs in Asia and Europe to accelerate the deployment of ultra-high-fiber-count cabling, leveraging its proprietary ribbon fiber technology.

- Furukawa Electric Co., Ltd. has prioritized alliances with construction and engineering firms to streamline the installation of its high-capacity fiber bundles in smart city and campus projects.

- Nexans is developing ecosystem partnerships to support sustainability goals, offering recyclable cabling components and collaborating with data center operators to reduce overall carbon footprints.

Looking to 2025 and beyond, manufacturers are expected to further intensify their competitive efforts by forming cross-industry alliances, particularly as the boundaries between telecom, data center, and cloud infrastructure continue to blur. The emphasis on software-defined infrastructure, coupled with the need for rapid network upgrades, is likely to drive even deeper integration between cabling system providers and network equipment manufacturers, shaping the next phase of confluent layer fiberoptic innovation.

Emerging Applications in Telecom, Data Centers, and Beyond

Confluent layer fiberoptic cabling systems are rapidly emerging as a cornerstone in the evolution of high-capacity communication infrastructures, particularly within telecom and data center environments. As of 2025, the accelerating deployment of 5G and the anticipated growth of 6G technologies are driving unprecedented demand for fiberoptic solutions that can efficiently manage ever-increasing data rates and bandwidth requirements. These systems, characterized by their seamless integration of multiple fiber layers and advanced cable management, are designed to maximize density, minimize signal loss, and optimize scalability.

Telecom operators are at the forefront of this shift. For instance, Nokia has been rolling out multi-layer optical networking solutions specifically engineered to support dense urban 5G backhaul and fronthaul, leveraging confluent cabling to achieve both high performance and streamlined maintenance. Similarly, Cisco Systems has expanded its optical portfolio to include cabling systems that facilitate multi-layer convergence, enabling network operators to meet surging traffic demands without overhauling physical infrastructure.

In the data center sector, hyperscale operators are rapidly adopting confluent layer fiberoptic cabling to address challenges of space, power, and cooling. Corning Incorporated offers high-density cabling solutions with innovative layer management, which enable operators to scale up capacity and simplify moves, adds, and changes. These solutions are integral to modular data center designs, which are projected to become more prevalent through 2025 and beyond as organizations prioritize flexibility and sustainability.

Beyond traditional telecom and data centers, confluent layer systems are finding new applications in emerging sectors like edge computing, smart cities, and industrial automation. CommScope is actively working with municipalities and utilities to deploy converged fiber networks that support both critical infrastructure and smart applications, including IoT sensor grids and autonomous transport systems.

Looking forward, industry stakeholders anticipate further innovation in materials, cable design, and automated installation techniques. With the push toward AI-driven network management and the proliferation of ultra-low latency applications, the importance of robust, scalable, confluent layer fiberoptic cabling systems will only intensify. Standards development organizations such as Telecommunications Industry Association are also accelerating efforts to codify best practices, ensuring interoperability and reliability as these systems become the backbone of next-generation digital infrastructure.

Regulatory Standards and Industry Initiatives (e.g. ieee.org, tiaonline.org)

The evolution of confluent layer fiberoptic cabling systems, which integrate multiple fiber layers and pathways for high-density, high-reliability data transmission, is increasingly shaped by regulatory standards and industry initiatives. As of 2025, key industry bodies are actively updating and harmonizing standards to address the sophisticated requirements of these systems, which are critical in data centers, 5G/6G backbone infrastructure, and high-performance computing environments.

The Institute of Electrical and Electronics Engineers (IEEE) continues to play a central role. The IEEE 802.3 standards, which define Ethernet technologies over fiber, are undergoing iterative enhancements to support higher bandwidths and greater channel densities, directly impacting how confluent layer cabling is specified and deployed. Current projects focus on 400G, 800G, and emerging Terabit Ethernet, necessitating new cabling architectures with improved crosstalk isolation and tighter loss budgets.

Parallel to this, the Telecommunications Industry Association (TIA) is revising its TIA-568 and TIA-942 standards, which cover structured cabling for commercial and data center environments. In 2025, draft updates incorporate guidance for multi-layer and multi-path deployments, emphasizing modularity, scalability, and the accommodation of multi-fiber push-on (MPO) and very small form factor (VSFF) connectors—both crucial for confluent cabling. These standards are also aligning with sustainability goals, encouraging the use of materials and installation practices that support longer lifecycle management and easier upgrades.

The International Organization for Standardization (ISO) and International Electrotechnical Commission (IEC) joint technical committee (ISO/IEC JTC 1/SC 25) is also advancing the ISO/IEC 11801 series for generic cabling. Recent work includes detailed specifications for multi-tiered cable routing and redundancy in converged infrastructures, areas where confluent layer designs excel. These specifications are expected to be finalized and adopted across more regions by 2026.

- Several industry working groups are piloting interoperability tests for next-generation multi-layer fiber management solutions, ensuring standards compliance and vendor-neutral deployments (TIA).

- There is growing emphasis on cybersecurity and physical infrastructure security in new standards, reflecting the critical role of confluent systems in national and enterprise networks (IEEE).

Looking ahead, regulatory and industry bodies are expected to further refine standards to support AI-driven network management and dynamic reconfiguration in confluent layer fiberoptic systems, ensuring these architectures remain robust, scalable, and secure as digital transformation accelerates globally.

Market Forecasts: Projections to 2030 and Scenario Analysis

The market for Confluent Layer Fiberoptic Cabling Systems is anticipated to witness robust growth through 2030, driven by the accelerating demand for high-capacity, low-latency data transmission across telecommunications, data centers, and enterprise networks. As of 2025, several factors are converging to shape the sector’s outlook: massive investments in 5G and next-generation network infrastructure, surging data traffic from cloud computing and AI applications, and expanding adoption of fiber-to-the-premises (FTTP) deployments.

Major industry players are actively scaling up their manufacturing and deployment capabilities. For instance, Corning Incorporated has reported significant expansion in its optical fiber and cable production, with a focus on advanced cabling solutions tailored for dense urban and hyperscale data center environments. Similarly, CommScope continues to introduce fiber cabling architectures designed to support high-density, scalable, and easily managed network layers, addressing the market’s shift toward confluent and converged solutions.

Industry data from organizations such as the Fiber Broadband Association indicates that fiber network passings are expected to exceed 100 million premises in North America by 2026, with a compound annual growth rate (CAGR) for new fiber installations projected in the high single digits through the decade. This expansion is creating downstream demand for highly integrated, low-loss cabling systems that enable seamless data transmission across converged network layers.

Looking toward 2030, scenario analyses suggest that Confluent Layer Fiberoptic Cabling Systems will play a crucial enabling role in the evolution of smart cities, edge computing, and the industrial Internet of Things (IIoT), where ultra-reliable, high-bandwidth connectivity is imperative. Companies such as Prysmian Group are forecasting increased adoption of advanced fiber cabling architectures, including all-dielectric self-supporting (ADSS) and micro-duct solutions that support confluent layering in both greenfield and brownfield deployments.

In summary, the outlook for Confluent Layer Fiberoptic Cabling Systems to 2030 is underpinned by strong investment in digital infrastructure, continual innovation by major manufacturers, and the growing need for network architectures that can flexibly support the next generation of data-intensive applications. Ongoing collaboration between manufacturers, network operators, and standards bodies is expected to further accelerate the adoption of confluent-layer cabling as a foundational technology of the digital economy.

Challenges, Risks, and Barriers to Adoption

As the deployment of confluent layer fiberoptic cabling systems accelerates in 2025, the sector faces a series of challenges, risks, and barriers that could affect adoption rates and long-term viability. Key constraints include technical, economic, regulatory, and infrastructural considerations.

- Complexity of Integration: Integrating confluent layer designs with legacy infrastructures remains a substantial hurdle. Many existing networks, especially in metropolitan and campus environments, were not engineered for high-density, layered fiber arrangements. Retrofitting such spaces often requires significant reconfiguration and, in some cases, new ducting or pathway installations—adding both cost and operational disruption. Leading providers such as CommScope highlight the importance of tailored integration solutions to overcome these difficulties.

- Installation and Maintenance Expertise: The specialized nature of confluent layer systems demands advanced skills in splicing, connectorization, and testing. There is a growing shortage of technicians adequately trained for these high-density, multi-path architectures, as observed by Corning Incorporated. Training programs are ramping up, but the skills gap persists in 2025, posing a risk to deployment timelines and network reliability.

- Cost Considerations: Although the long-term benefits of confluent layer solutions include greater bandwidth and space efficiency, the up-front capital expenditure remains higher than for traditional cabling systems. For many organizations, especially mid-sized enterprises and public sector entities, securing funding for such projects is challenging—particularly when budget cycles are constrained or other IT priorities compete for resources (Leviton Manufacturing Co., Inc.).

- Standardization and Compliance: As of 2025, global standards for confluent layer fiberoptic architectures continue to evolve. The lack of universally accepted specifications can result in interoperability issues between products from different manufacturers and complicate future upgrades. Industry bodies such as the Telecommunications Industry Association (TIA) are working on harmonizing guidelines, but gaps remain.

- Environmental and Physical Constraints: High-density fiber systems are more susceptible to microbend and macrobend losses, especially where routing space is minimal. Additionally, ensuring adequate thermal management and minimizing physical stress on the cables in crowded environments is a persistent challenge, as noted by Panduit Corp..

Looking ahead, progress in automated installation tools, improved training, and evolving standards is expected to mitigate some barriers. However, the sector must continue addressing these multifaceted challenges to unlock the full potential of confluent layer fiberoptic cabling through 2025 and beyond.

Strategic Recommendations and Future Outlook

As the demand for high-capacity, low-latency data transmission intensifies across industries, confluent layer fiberoptic cabling systems are poised to play a pivotal role in shaping next-generation digital infrastructure. The strategic imperatives for stakeholders in 2025 and beyond center on enhancing network scalability, reliability, and sustainability, particularly in hyperscale data centers, 5G deployments, and smart city grids.

Strategic Recommendations

- Prioritize Modular and High-Density Designs: Emphasizing modular cabling solutions enables seamless scalability and rapid deployment. Companies such as CommScope and Corning Incorporated have introduced high-density, pre-terminated fiber systems that support plug-and-play expansion, critical for supporting evolving bandwidth requirements without significant downtime.

- Embrace Convergence of Multiple Fiber Layers: The integration of multiple fiber layers within a single cabling infrastructure minimizes spatial footprint and optimizes cable management. Panduit is actively advancing solutions that allow for confluent routing of data, control, and power over unified fiberoptic backbones, reducing complexity and operational costs.

- Invest in Automation and Monitoring: Fiberoptic networks are increasingly leveraging intelligent monitoring systems for predictive maintenance and performance optimization. Legrand and Belden Inc. offer cabling systems equipped with embedded sensors and software analytics, enabling real-time asset management and reducing mean time to repair (MTTR).

- Focus on Sustainability and Future-Proofing: The move toward eco-friendly materials and reusable architectures is gaining momentum. Leading manufacturers are adopting low-smoke, zero-halogen (LSZH) jackets and recyclable components in their confluent fiber products to meet regulatory requirements and corporate sustainability goals.

Future Outlook (2025 and Beyond)

The next several years will witness accelerated adoption of confluent layer fiberoptic cabling as organizations address the surging data volumes generated by artificial intelligence, edge computing, and IoT ecosystems. The shift toward all-fiber infrastructures will be reinforced by advances in optical transceiver technology and tighter integration with wireless networks for seamless end-to-end connectivity. Industry leaders are expected to double down on R&D to deliver innovative architectures that accommodate both legacy and future protocols, ensuring long-term investment protection. Additionally, global standardization efforts—spearheaded by groups such as the Telecommunications Industry Association—will drive interoperability and facilitate broader market adoption. Stakeholders who align their cabling strategies with these trends will be best positioned to capitalize on the evolving digital landscape.

Sources & References

- CommScope

- Panduit

- Senko Advanced Components

- Nexans

- Belden Inc.

- Legrand

- Telecommunications Industry Association

- Prysmian Group

- Furukawa Electric

- International Telecommunication Union (ITU)

- Cisco Systems, Inc.

- CommScope Holding Company, Inc.

- Sumitomo Electric Industries, Ltd.

- Nokia

- International Organization for Standardization (ISO)

- Leviton Manufacturing Co., Inc.